PENTA NEWS

PENTA NEWS

EVERYDAY MATH

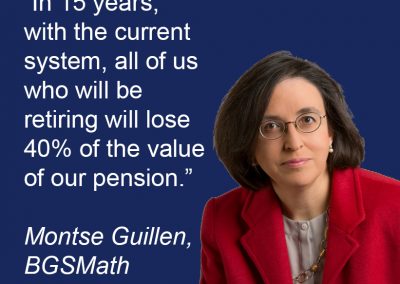

“Your best asset is you.” The expert warns: pensions will inevitably be lower in the future

Risk expert Montse Guillen has strong opinions about pensions. She notes that the current pension system in Spain and in many other western countries is mathematically unsustainable and believes it should be totally redesigned, giving more responsibility to the individuals. The key factors that make it unbalanced are increasing life-expectancies, low salaries and the need to guarantee an basic income level to all pensioners. Possible solution? Lower pensions at 65, higher after 80.

Pensions are provoking heated discussions in Spain, with many retired people protesting in the streets. The government is working on a budget law that raises pensions by a bit more than the meager 0.25% that was planned years ago in the middle of a major financial crisis, with inflation around 0%. Today the inflation rate in Spain is above 1%.

UB professor and BGSMath faculty member Montserrat Guillen is an expert in risk assessment. She manages the Riskcenter, the Research Group on Risk in Insurance and Finance, and is an ICREA Academia awardee. Penta asked her how a mathematician looks at the pension issue altogether.

“There’s a book that came out recently called The 7 most important equations for your retirement. I find it a good starting point for all those who want to start looking into their retirement with a mathematical approach,” says Guillen. “In it, Moshe Milevsky, a world expert in financial mathematics, argues that 21st century retirement income planning is indeed a science and has its foundations in the work of great sages over the last 800 years.” For those interested in the mathematical derivation of the formulas, here a technical paper about them. “In essence,” adds Guillen, “what we do is to calculate the ‘risk’ of surviving to our capacity of generating richness”.

Give us some examples of these key equations.

The Italian Fibonacci (XIII century) calculated how long a fortune that is depleted with an annual percentage last. The Briton Benjamin Gompertz (XIX century) established the key mortality laws that allow you to estimate how long you will survive after your retirement. The British astronomer Edmond Halley (XVIII century) described the value of a regular income in relationship with the interests of the investments. The US economist and statistician Irving Fisher calculated the behavior of interest rates when inflation is changing. The very influential US economist Paul Samuelson (who died in 2009), among other things, studied how to diversify investments. Another American, Solomon Huebner (XX century), known as the “father of insurance education” and who introduced the concept of “human life value”, is the first one to recognize the need for solidarity among people. Finally, the Soviet mathematician Andrey Kolmogorov (XX century), among many other fundamental results, found the formula for the lifetime ruin probability.

In mathematics we trust.

Well, personally I believe much more in the statistical regularity than in an analytical formula for financial markets. That’s why I prefer good insurance to a bad investment. If you look at the problem with mathematical tools, what you have is two components of the problem. On one side, it’s a statistical problem: what is the probability to pass each stage of your life, which depends on how much time you lived until then. Secondly, a financial problem: do I want to face the risk on my own, or share the risk with others (for example, with a private pension scheme).

Is an insurance policy the right solution for your pension?

What insurances do is eliminate the risk of ending up with no money at a moment in your life when you cannot work anymore and your savings are gone. This is the reason why governments created social security. It is ultimately a compulsory insurance.

So, problem solved?

I believe that the way the public pension scheme is designed nowadays is not working. It is not sustainable even after the reforms. The first years you stop working, you should be using your savings. After a certain age – say 80, or 85 – this is when you should receive a payment. That’s when the “compulsory insurance” should cover your payments.

This is quite shocking to many.

The model would be more sustainable. The entry level of the pensions would be very low for the first years. Those who want higher income then should use their own savings. Starting at 80 or 85 the amount of the monthly payment should be raised. People would only have to worry about their savings for the first 15 to 20 years, eliminating what we call “longevity risk”. What we do is share responsibility. The first part, it would be the responsibility of the individual, with his or her own expectations and desires; after that, there must be solidarity.

At the current salary level, for many people saving money is unthinkable.

Salaries should be higher and as a consequence the social security would have a larger inflow and be less distressed. But I am convinced the system has to change, because the way it is now is a fraud. You cannot mix an insurance principle with compulsory spending to pay every pensioner an income. Otherwise it will be inevitable for retirement age to go up. More than 50% of the retired people live over 20 years after their pension.

You are advocating for private insurance.

The pension sector is based on mathematics, regulation and supervision. The State has to guarantee a minimal public system and, in addition, a viable, mathematically sound and fair private system.

Would you feel comfortable with a system like this?

If we implemented a system like the one I described, you would really only have to contract a supplementary private source of income for few years, from 65 to 80 or 85. We cannot take a decision at 65 for the rest of our life: a fourth of the population lives longer than 30 years after pension, that’s a third of your life! So the best strategy is to segment the decision into smaller chunks. The real issue is that governments keep changing the taxing system. It’s not the same if 30 years from now you have to pay 30% or 40% of your income in taxes.

What do you think of the formula used by the Spanish government to raise the value of pensions? Is 0.25% enough?

The formula the government used is wrong, but not for the reasons that many think. The formula aims at equilibrating the incomes with the expenses of the system but it contains many mistakes. It mixes arithmetical averages with geometrical averages, it uses an average instead of a median when the distribution is very asymmetric, and it fixes arbitrary factors that have no meaning. The sad truth is that with the current arrangement, to balance the system, the pensions would have to be lower.

This would not be very popular.

I know. There’s also another part of the equations. The evolution of life expectancy from the retirement age onwards. We are now worried about this 0.25%. But in 15 years, with the current system, all of us who will be retiring will lose 40% of the value of our pension compared to today’s levels.

It is not a very uplifting prospective.

I always say that your best asset is yourself: you are the main source of your own richness, you are your own company. We are not used to think about ourselves like that. But the consequence of this is that you are the one who has to establish until when you ought to work, and how to invest your savings. With the prospect of a low pension awaiting us, the best strategy, as with any risky business, is to diversify the investment, which is what we study as risk experts. There are of course also other types of risks: you might get sick. This is why in our social security system there are mechanisms, like the disability retirement to protect us from these risks.

Participants